Marriage Forms

Hotel/Motel Forms

Title and Registration Forms

- Affidavit of Inheritance

- Affidavit of Non Dealer Transfer of Motor Vehicle and Boat

- Affidavit of Seller In Cases of Bankruptcy, Insolvency, Attachment, Replevin, or other Judicial Sale

- Affidavit of Replacement

- Application for Disabled Person License Plate and-or Placard

- Application for Duplicate Title

- Application for Motor Vehicle Indentification Certifcation

- Application for Noting of Lien

- Application for Special Amateur Radio License Plates

- Application for Specialty License Plate

- Application for Tennessee Salvage Certificate

- Boat Bill of Sale

- Certification of Ownership Application - Note: Applications submitted in this manner are stringently examined due to the potential for fraud. Most requests are rejected due to improper documentation or circumstances that make the vehicle eligible for titling supported by the proper transfer documents or a potential of fraud is detected. The fact that the previous seller did not furnish a title to you when you purchased it does not qualify for the certification process and is a civil matter per Tenn. Code Ann. Section 55-3-127.

- Certification of Sales Under Special Conditions

- Discharge of Lien

- Emergency License Plate Authorization Form/Authorization for the Purchase of an Emergency Vehicle - For use when acquiring emergency plates or selling a government owned emergency vehicle. Please note that this form consists of two parts: Side A - Emergency Plate Authorization and Side B - Authorization for Purchase. Please read all instructions carefully before filling out this form.

- General Affidavit

- Leased Vehicle Authorization

- Low Speed Vehicle Affidavit

- Medium Speed Vehicle Affidavit

- Motor Vehicle Bill of Sale

- Multi-Purpose Application

- Odometer Disclosure Statement

- Odometer Discrepancy Certification

- Power of Attorney for Vehicle Transactions

- Request for Verification of Ownership on Vehicles Found Abandoned, Immobile or Unattended

- Surety Bond Application

- Vehicle Information Request

Privacy is a Priority

Privacy on the web is a priority. We inform our visitors about the types of information we collect and how we use it. We save messages we think might be needed for customer call back. We only keep email addresses on file for our customer service records. We DON'T sell or give out email addresses to companies.

Refund Policy

Cancellation requests for any online service paid by credit card must be received before the designated date of processing. If the request is not received before the specified date, the Convenience fee, Processing Fee, or Credit Card Fee will be charged.

Hotel and Motel Tax

Vehicle Tax Calculator

Business Tax

The Business Tax Act makes it a taxable privilege to make sales or engage in any vocation listed in Tenn. Code Ann. Sections 67-4-708(1) - (4). Any county or incorporated municipality on Tennessee may levy the privilege tax on those listed activities that take place within its geographical boundaries. (Tenn. Code Ann. Section 67-4-704) Engaging in any business, business activity, vocation, or occupation described under this act is declared to be a privilege for state purposes and taxable by the state alone. (Tenn. Code Ann. Section 67-4-705) The tax imposed under the Business Tax Act may be collected in addition to any other applicable privilege taxes established by law. The tax will be in lieu of any or all ad valorem taxes on the inventories of merchandise held for sale or exchange by persons taxable under this law. (Tenn. Code Ann. Section 67-4-701)

"Business" Defined

"Business" includes any activity engaged in by any

person with the object of gain, benefit, or advantage,

either directly or indirectly. Business does not

include occasional and isolated sales or transactions

by a person who is not routinely engaged in business.

Occasional and isolated sales, also known as casual

and isolated sales, are sales made by persons not in

the business of regularly selling the type of property

being sold. Occasional and isolated sales are also

sales of tangible property taking place only during

temporary sales periods of 30 days or less and

occurring no more than twice per year such as the

sale of Girl Scout cookies.

Business also does not include an individual

property owner that utilizes a property management

company to manage vacation lodging for overnight

rentals.

|

Tennessee Department of Revenue Taxpayer Services Division Andrew Jackson Building, 3rd Floor 500 Deaderick Street Nashville, Tennessee 37242-1099 |

Toll Free: (800) 342-1003 Out-of-state: (615) 253-0600 TDD: (615) 741-7398 |

Regional Offices

|

Chattanooga:

540 McCallie Avenue Suite 350 Chattanooga, TN 37402 (423) 634-6266 |

Jackson:

Lowell Thomas State Office Building 225 Dr. Martin L. King Jr. Drive Room 405-B Jackson, TN 38301 |

Johnson City:

204 High Point Drive Johnson City, TN 37601 (423) 854-5321 |

|

Knoxville:

531 Henley Street Room 606 Knoxville, TN 37902 (865) 594-6100 |

Memphis:

3150 Appling Road Bartlett, TN 38133 (901) 213-1400 |

Morristown:

511 West Second North Street Morristown, TN 37814 (423) 586-1993 |

Boat Registration

Tennessee law requires that all mechanically powered vessels (including documented vessels) and all sailboats which are principally used in Tennessee must be registered. Mechanical propulsion includes electric trolling motors but does not include boats powered only by oars or paddles. Boats which require registration must be properly registered before using them upon any public water of Tennessee. Currently registered boats from other states may use Tennessee waters for a period not to exceed 60 consecutive days. Exception: Sailboats brought into Tennessee by persons from states that do not require numbering of sailboats are exempt from registration provided that Tennessee is not the state of principal use and that the vessel will not be used on Tennessee waters over 60 consecutive days.

Registration Fees

Registration fees are determined by the length of the boat. The vessel may be

registered for one, two or three years upon option by the owner. However, if

an owner acquires another boat, there is no transfer of fees from one boat to

another.

| Vessel Fee Category | 1 Year | 2 Year | 3 Year |

|---|---|---|---|

| 16 feet and under | $15 | $28 | $41 |

| Over 16 feet to less than 26 feet | $29 | $56 | $83 |

| 26 feet to less than 40 feet | $44 | $84 | $125 |

| 40 feet and over | $59 | $113 | $166 |

| Dealer / Manufacturer | $37 | $75 | $111 |

| Duplicate | $7 |

How to Register

Persons who wish to register a boat must complete a registration form, available

through a county clerk's office or from the dealer that sold you the boat.

Initial Registration: The Tennessee Department of Revenue requires that boats which have never been registered before must show certification that their sales tax was paid when purchased. The owner needs to have the appropriate county clerk's office or boat dealer stamp on the application verifying that the tax was paid. The registration form is then mailed to or taken to the address shown on the form for processing.

Registered Boats transferred from one individual to another: Follow the same process as described for previously unregistered boats above. If a dealer is not involved, the county clerk's office will require a bill of sale from the individuals involved.

Renewing a registration that does not involve a change of ownership: You may renew instantly by going to any business that sells TWRA hunting and fishing licenses. You must have the boat registration TN number and it is very helpful to have your TWRA ID number with you. You will receive a temporary registration which will allow you to operate your boat until your new decals and registration card arrive by mail, in about 2 weeks.

Registration by Dealers or Manufacturers: Dealers or manufacturers may apply for registration which can be transferred from one vessel to another. A copy of the business license and sales tax number must accompany the application for a dealer or manufacturer number. Such vessels are to be used for demonstration purposes only and more than one vessel may not be operated simultaneously with the same number. In addition, vessels being demonstrated must have the Certificate of Number on board and the registration number must be correctly displayed. However, such vessels may display the number by having it attached to removable signs which can be temporarily but firmly attached to the vessel.

Source: https://www.tn.gov/twra/boating#registration

Marriage License Information

Before a marriage can occur in Tennessee, a license must be obtained from a County Clerk. Ministers of the Gospel, Rabbis, Christian Science practitioners, and various civil officials are authorized by law to solemnize a marriage.Marriage license requirements are specific to each applicant's age. Please refer to the following guidelines:

18 Years of Age or Older

-Blood tests not needed

-No waiting period

-ID requirements:

One of the following: State certified birth certificate, Driver License, State Issued ID

-Identification guidelines for Legal Aliens who do not have a social security number:

1) Each with valid expiration dates: Passport and American Visa, or

2) Resident Alien Card

-Please contact your county for specific fees.

-You must know the following:

Parents full name (including maiden name of mother)

Parents state of birth and address (if living)

Applicant's number of prior marriages

Date last marriage ended (if applicable)

-A marriage license is valid for 30 days after issuance and may be executed outside of Tennessee. However, it must be returned to the issuing Clerk for recording and filing with the Tennessee Vital Records Office.

17 Years of Age

-Blood tests are no longer needed

-If applicant is 17 years of age, the other party has to be within four years their senior.

-Consent of parents, guardian, or next of kin (unless minor emancipated).

-Parent or guardian must accompany in applying for license. Custodial Parent must bring custody papers (if applicable) to show proof of custody.

-Identification guidelines for Legal Aliens:

1) Each with valid expiration dates: Passport and American Visa, or

2) Resident Alien Card

-ID requirements:

-Proof of Social Security Number (Social Security Card or Driver License containing SSN)

-Please contact your county for specific fees.

-You must know the following:

Parents full name (including maiden name of mother)

Parents state of birth and address (if living)

Applicant's number of prior marriages

Date last marriage ended (if applicable)

-A marriage license is valid for 30 days after issuance and may be executed outside of Tennessee. However, it must be returned to the issuing Clerk for recording and filing with the Tennessee Vital Records Office.

Specialty Marriage Certificate

Specialty Marriage Certificates are the perfect keepsake.

Each Specialty Certificate will be in a 11X14 matted frame.

Specialty Marriage Certificate Example:

Specialty Marriage Certificate

Specialty Marriage Certificates are the perfect keepsake.

Each Specialty Certificate will be in a 11X14 matted frame.

Specialty Marriage Certificate Example:

Check your county for availability

Disabled Plates/Placards

Disabled individuals must have form SF0953 completed by a physician to obtain plates or placard. If purchasing a plate, an individual has to be a registered disabled person. Disabled license plates cost $29.00 plus applicable wheel tax. If an individual is permanently confined to a wheel chair, the plate is free. If a disabled individual obtains plates, the placard is free. If no plate is purchased, the placard is $26.50, and it is renewable every two years for $3.Notary Commission Services

Involves issuing and maintaining records relating to notary commissions.NOTE: For notary application and election information, please contact your County Clerk's Office.

WHAT IS A NOTARY PUBLIC FOR THE STATE OF TENNESSEE?

A Notary is a county public official whose powers and duties are defined by statute. Basically, a Notary has the power to administer oaths and take depositions, affidavits and acknowledgments. A Notary's powers and duties can be exercised in all counties in the State of Tennessee.

ARE THERE ANY RESTRICTIONS ON BECOMING A NOTARY?

Statutory age, residency and qualification requirements are specified in TCA §8-18-101 and §8-16-101. It is a misdemeanor to take office as a Notary if a disqualification exists.

HOW DOES A PERSON BECOME A NOTARY?

A Notary is elected by the county legislative body in the county in which the applicant, at the time of his/her election, resides or maintains his/her principal place of business. An application and a fee (part of which will go the County Clerk's office and part to the Secretary of State) must be submitted to the County Clerk. The County Clerk certifies an election of the applicant by the county legislative body and forwards the certification and the State fee to the Secretary of State, Division of Business Services. Upon receipt of the election certification and the State fee from the County Clerk, the Division of Business Services prepares, records and forwards to the County Clerk the notary commission signed by the Governor and the Secretary of State. The County Clerk records the notary commission and notifies the person to whom the commission was issued. After an oath has been taken and bond posted, the County Clerk delivers the notary commission to the person elected.

WHAT IF A NOTARY MOVES FROM THE COUNTY OF ELECTION?

If a Notary moves his/her residence or principal place of business out of the county from which he/she was elected to another Tennessee county, the Notary remains qualified to act as a Notary, but must notify the County Clerk of the county from which he/she was elected, and the County Clerk in turn will notify the Secretary of State, Division of Business Services of the change of address. A processing fee of $7 ($5 for the County Clerk and $2 for the Secretary of State) must be submitted to the County Clerk. If a Notary moves his/her residence or principal place of business out of the State of Tennessee, he/she is no longer qualified to act as a Tennessee Notary and must surrender his/her commission.

WHAT IS THE TERM OF A NOTARY?

A Notary's term of office is four years, beginning on the date that the notary commission is issued by the Governor. A notary commission can be renewed through the same method as the initial election (see above). It is a Class C misdemeanor for a Notary to act in an official capacity after the expiration of the notary commission.

WHAT ARE THE REQUIREMENTS FOR AN OFFICIAL SEAL?

State law requires all Notaries to use a seal design prescribed by the Secretary of State. Pursuant to Rule 1360-7-2-.01(1), a Notary commissioned on or after July 1, 2004, must use a seal that substantially conforms to the following design: a circular seal with the Notary's name (as it appears on the commission) printed at the top, the county of election printed at the bottom, and the words "State of Tennessee Notary Public" or "Tennessee Notary Public" printed in the center. A sample seal format appears below:

HOW ARE COMPLAINTS AGAINST A NOTARY HANDLED?

A Notary is considered a county public official and may be removed from office just as any other county official. Complaints concerning official misconduct should be directed to the appropriate official (such as the County Attorney or the District Attorney General) in the county in which the Notary is elected or in which the alleged misconduct occurred.

HOW CAN THE NAME OF A NOTARY AS COMMISSIONED BE CHANGED?

A Notary whose name has been legally changed can obtain a new commission by submitting to the Division of Business Services (through the County Clerk) the original commission, a statement from the County Clerk indicating that the legal name has changed and identifying the former and current names, and payment of a $5 fee to the Secretary of State. The new commission will be forwarded to the County Clerk for delivery to the Notary.

ARE THERE ANY NOTARY ADVERTISING RESTRICTIONS?

Restrictions and disclosure notices may apply to advertising by certain Notaries. Please review the consumer protection provisions found in Title 8, Chapter 16, Part 4 of Tennessee Code Annotated.

WHERE CAN I OBTAIN NOTARY INFORMATION?

For Notary application and election information, please contact your County Clerk. The Secretary of State, Division of Business Services maintains an Internet website that includes some Notary information and a searchable database of current notary commissions. The Division's site may be accessed via the Secretary of State's home page at: www.state.tn.us/sos/ The Secretary of State, Division of Business Services is neither authorized nor qualified to provide legal advice relative to Notaries or their powers and duties. Please contact an attorney or other qualified professional for such information.

Titling a Vehicle

To title and register your new vehicle, you will need to submit to your resident county clerk the following:-Manufacturer's Statement of Origin

-the new vehicle's invoice and

-a copy of your current registration if transferring your license plate

To title and register a used vehicle, submit to your resident county clerk the following:

-a valid certificate of title properly assigned along with an Odometer Disclosure Statement, if applicable

-a copy of the current registration if transferring your license plate

Please note: You will need to provide proof of identification and proof of residency when titling and registering your vehicle.

Hunting and Fishing License

Hunting and Fishing Licenses may be purchased at your County Clerk's Office. For online information regarding licensing, please refer to www.tn.gov/twra.Note: Some counties may not offer Hunting and Fishing Licenses.

Auto Dealer Information

If you sell more than five vehicles in a calendar year in Tennessee, you must have a dealer license.Requirements to Apply for a Dealer License

-An approved building facility physically separate from all other buildings, with office furniture and a working telephone (cell or mobile phone not acceptable as primary line).

-A vehicle display area large enough to fit 15 vehicles.

-To meet the sign requirements of a minimum letter height (per ordinance), permanently installed, and visible from the road.

-A garage facility or a service agreement with a nearby garage.

-Certificate of Liability Insurance (minimum $300,000)

-Business tax license

-Sales tax identification number

-Personal and/or financial check disclosure

-Financial statement prepared by a CPA

-Zoning compliance

-Franchise agreement letter from the manufacturer

-Two-year surety bond

If applicable:

-Stockholders update

-City tax license

-Corporate charter

-Warranty rate form

Fees

-New vehicle dealer: $400, per line make

-Used vehicle dealer: $400

-New motorcycle dealer: $400, per line make

-Salesperson or change of employer endorsement: $35

-Motor vehicle show permit: $200

-RV dealer: $400

-Manufacturer, distributor, factory branch, or distributor branch: $1600

-Factory distributor representative: $400

-Auto Dismantler/Recycler: $400

-Automobile auction: $800

-All duplicate licenses: $25

For more information, refer to www.dmv.org

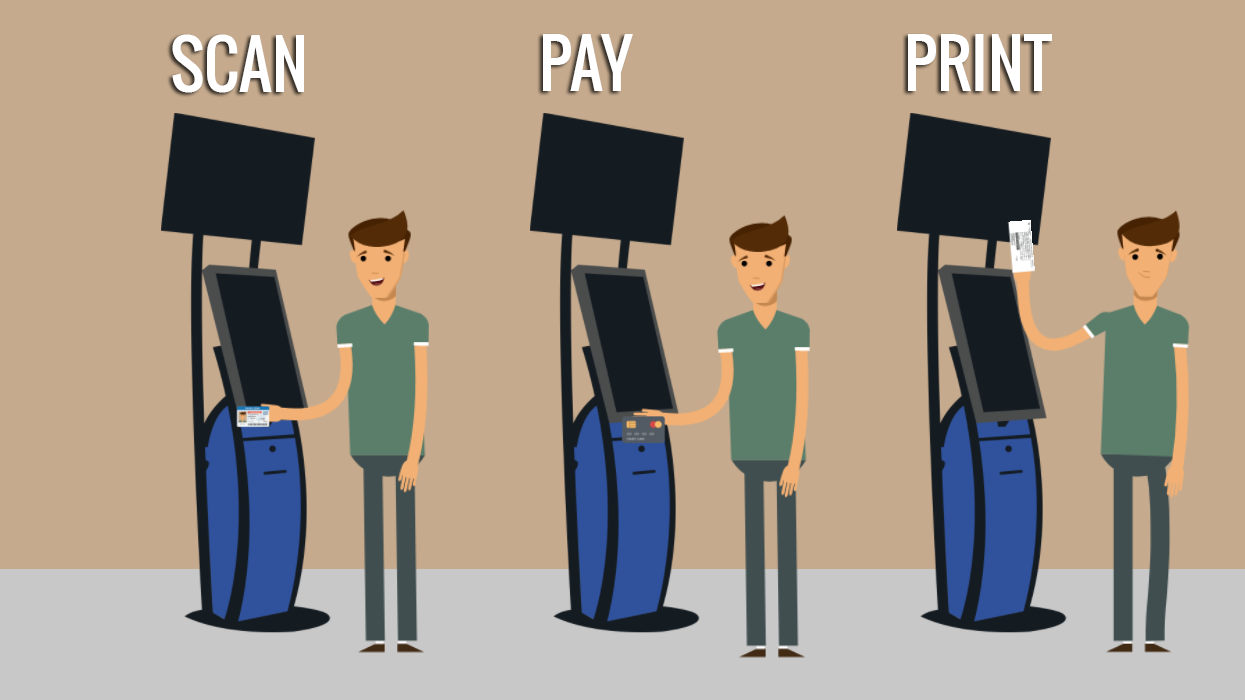

SELF-SERVICE VEHICLE RENEWAL KIOSK

Avoid lines and quickly renew your registration by using a self-service kiosk. Just scan your current registration or driver's license, select your vehicle, and pay with a debit or credit card.

After a successful renewal, your registration and renewal decal will print immediately at the kiosk. In just a matter of seconds you will have your renewed registration and be on your way.

Kiosk Locations

Additional Information

Payments are accepted by credit or debit card.

*Card types accepted may vary by location.

A convenience fee will be charged by a third party vendor for all transactions. The convenience fee is in addition to any renewal fee or taxes that may be due.

Self-Service kiosks are only available at participating counties. Please check the kiosk locator above for all locations and hours.

Payments are accepted by credit or debit card.

*Card types accepted may vary by location.

A convenience fee will be charged by a third party vendor for all transactions. The convenience fee is in addition to any renewal fee or taxes that may be due.

Self-Service kiosks are only available at participating counties. Please check the kiosk locator above for all locations and hours.

Vehicle Renewal Requirements

![]() Your vehicle(s) must be registered in a participating county.

Your vehicle(s) must be registered in a participating county.

![]() You must have your current registration or driver's license.

You must have your current registration or driver's license.

![]() You must have a vehicle Emission Inspection on file (if applicable).

You must have a vehicle Emission Inspection on file (if applicable).

![]() You must have proof of liability insurance on file (if applicable).

You must have proof of liability insurance on file (if applicable).